Highway Robbery: Sports’ Worst Contracts and Their Scam Equivalents

Tipping used to be a fairly straightforward institution. You tipped the server because they made $2.13 an hour and sprinted around with pitchers of Diet Coke while you debated whether jalapeño poppers counted as vegetables. You tipped the pizza delivery driver because you had figured out exactly the right combination of pizza and time of day to order to take maximum advantage of that 30 minutes or it’s free scheme. You hooked your bartender up because much like your 401k, it compounds over time - only instead of the rule of 72 doubling your money it’s every dollar slid to the barkeep in excess of the drink cost inched their pouring elbow toward the sky just that much more. Now? The algorithm is shaking me down.

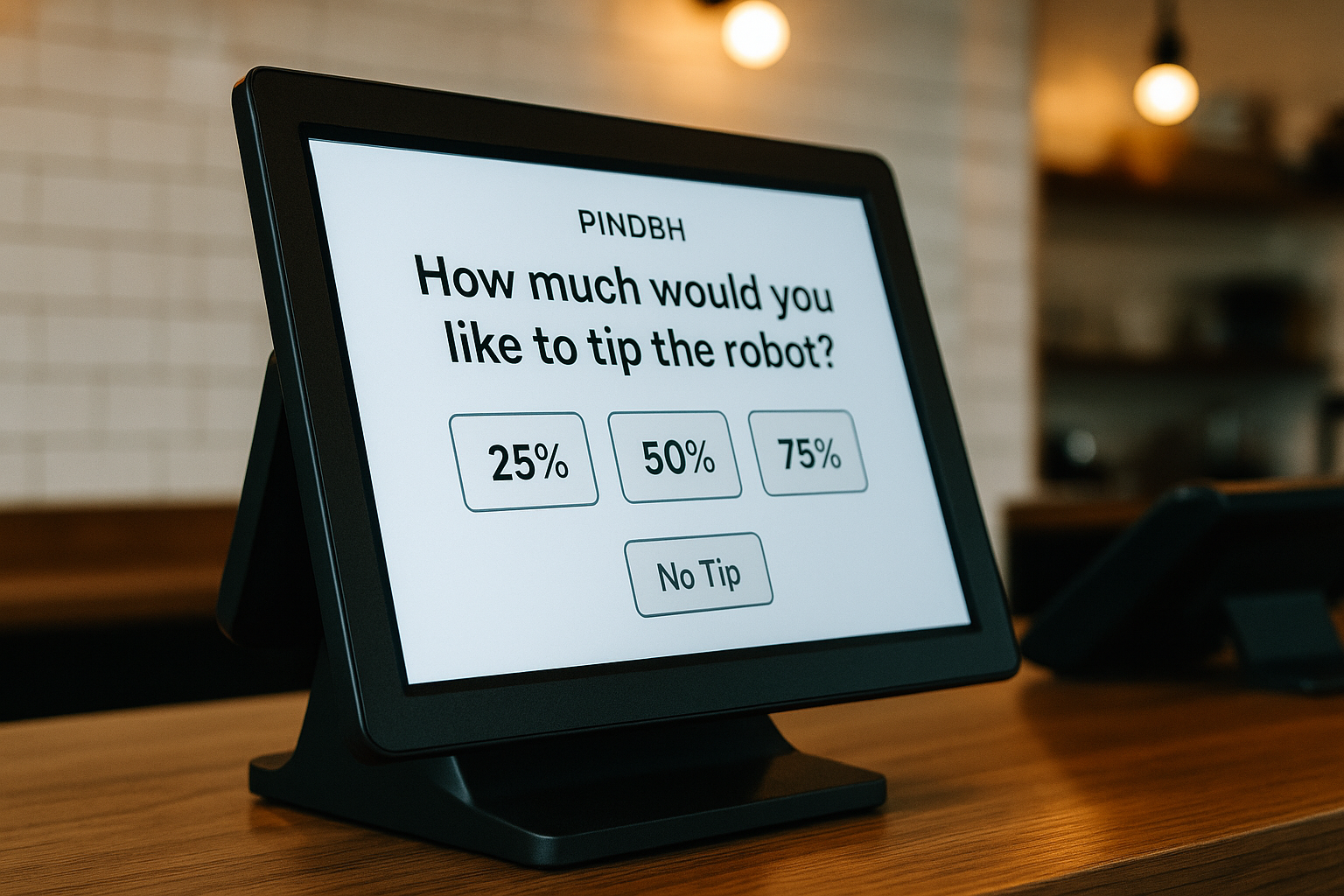

HVAC makes a house call because your AC suddenly isn’t doing anything about the daily race to 100 between temperature and humidity? How about leaving a gratuity on that $379 service call charge. Self-checkout machine? Would you like to leave a 20% tip for the machine after doing all the damn work yourself? Coffee kiosk that literally has no human within fifty yards? “Add a tip?” Buddy, the only service you provided was charging me $7 for bean water in a cardboard hat.

I got asked to tip on an online clothing order last week. An algorithm folded my socks, and suddenly it wants to retire on Martha’s Vineyard. It’s not a tip jar anymore—it’s ransomware with a smiley face emoji.

At this rate, death isn’t safe. The undertaker will flip his iPad around: “Would you like to leave a gratuity for embalming services? Suggested tip: 18%, 20%, or 25%.” The grieving family forced to hit “other” and type in, “He was cold anyway.”

And that’s the thing—we’ve turned tipping into the Bobby Bonilla of daily life. Perpetual payouts for no service rendered. You’re not thanking someone for hustling—you’re buying into a pyramid scheme where pressing “20%” is supposed to keep civilization from collapsing. Sports teams have been running the same con for years. They tip the wrong guy at the wrong time, and instead of a latte that costs you $7, it’s a contract that costs them $240 million.

So here’s the gallery of our cultural tip screens in sneakers: some of the most outrageous overpayments in sports history, each with its own financial fraud doppelgänger.

The King

By now, everyone knows about Bobby Bonilla. It’s become a running joke every July 1st whose punchline is LOL METS. But in case you’ve been living under a rock for the last decade plus, here are the Steve’s notes (let’s give Cliff a break, shall we?). Bonilla starts to suck. Mets don’t want him anymore. They come to an arrangement where instead of just paying Bonilla the remaining six odd million he’s owed to make a like a library and book, the team will pay Bonilla a prorated amount every July 1st until cockroaches roam the earth, or 2035 - whichever comes first.

The final tab? About 30 million. Or about 50 games of LeBron’s 2025 nut. Guess it ain’t THAT bad when you put it in perspective.

But this got us thinking. Bonilla is far from the only guy who has bilked his team the way Joel Osteen bilks his congregation for the promise of Saint Peter’s favor. What other contracts have been agreed to where if you didn’t know better, you’d swear Leonardo DiCaprio’s character from Catch Me if You Can was somehow involved in the negotiations.

The Ransom

First, the honorable mentions. It’s easy to point and laugh at the Angels’ absurd 10 year, $240 million dollar contract with Albert Pujols and swear Arte Moreno was smoking that good Orange County weed. However, as laughably ill-advised as this contract was, that was the cost of doing business. Multiple teams would gladly have paid Pujols similarly, knowing that the back end of that deal was going to look like Paulie from the Rocky movies on the back end of a bender. Ahhhh, RIP, Burt Young…

But the reason this doesn’t make the cut is because the Angels actually got most of what they paid for the first four years of that deal. Pujols continued to be one of the most productive hitters in baseball and played a decent enough first base to be involved in the Gold Glove conversations. It only went to hell after his feet did, rendering him essentially immobile. It also probably didn’t help that Pujols is likely several years older than his official MLB age because… well, reasons. To punctuate just how poorly this ended up looking for the Haloes, Pujols decided in 2022 to play one more season in St. Louis - where it all started for him - and promptly clobbered 24 home runs in part-time duty, OPSing an absolutely elite .895 at 42 (or 47, who the hell knows) years of age.

Then there’s Jamarcus Russell. The Raiders are another one of those franchises that’s immensely fun to ridicule for a multitude of reasons, but when you look beyond the ridiculously paltry return on their six year, $61 million dollar commitment to Russell, you’d have to concede the Raiders would be in pretty esteemed company. Despite the presence of the immensely talented Calvin Johnson in the same draft class, Russell was the consensus number 1 pick. An athletic freak with a howitzer for an arm and a successful college career at LSU, any one of 20 franchises would have made the same leap the Raiders did. There were questions about Russell’s work ethic but the extent to which he transformed from Adonis-like megastar in waiting to ballooned out of playing shape had to have surprised everyone. He was out of football after three years, which means that nobody even wanted to give him a second chance merely half way through his Raiders deal. Still, it was how first overall quarterback picks got paid. Just a few years later, the Rams selected Sam Bradford first overall and gave him a six year, $78 million dollar deal. He was better than Russell, but thanks to laundry list of cataclysmic injuries, had only marginally more success over his eight year career.

No, for this article, we wanted to focus on deals that made little sense at the time, and only got worse as time went on. So without further ado, the top three disastrous deals ever signed… well, disastrous from the teams’ perspectives. From the guys who benefitted, they’re lottery tickets.

Rick DiPietro, Goalie, New York Islanders

The Loot: 15 yrs, $67.5M, 2006

The Return: 238 games, 130 wins, endless injuries, franchise irrelevance.

Of the 238 games DiPietro gave the Isles after inking the deal, only 50 of them came after the 2007-2008 NHL season. To be fair, the Islanders couldn’t have known how brittle DiPietro would turn out to be. One of those reasons is that nobody has a crystal ball. Another one of those reasons is that DiPietro had played only 80 NHL games when the Islanders made their comical commitment to him. But hey, some gambles just don’t pay off! Win some, lose some! It’s true that even the best of franchises don’t win every bet but the good franchises place those bets with at least reasonable odds of winning. DiPietro’s performance to date had been right around league average. Deserving of employment? Sure. Getting paid like one of the game’s best for the better part of two decades? Someone in New York’s front office was well into the business end of a bottle of Courvoisier when that plan was hatched.

The Fraud Comp: Long-Term Capital Management. Oh, the 1990s. What a decade! Grunge music. Flannels. Hedge funds promising to make people rich with wildly risky strategies and limited oversight due to the fledgeling nature of the Internet.

Every generation has its own con job dressed up as genius. For the boomers it was disco. For millennials it was believing “YOLO” counted as financial advice. But in the 1990s, it was Long-Term Capital Management, a hedge fund with a name that aged about as well as milk in a sauna.

Picture it: Wall Street suits gathered around a green felt table, lighting cigars with Nobel Prize certificates, betting the mortgage on “math.” Not just math — the kind of math that made normal people feel stupid. “Don’t worry, this isn’t gambling, this is arbitrage. We’ve quantified the risk down to eight decimal places. See? Numbers can’t lie.” Spoiler alert: numbers can absolutely lie, especially when your spreadsheet is fed more assumptions than a drunk frat bro playing blackjack.

LTCM wasn’t running a scam the way Bernie Madoff ran a scam. Nobody was shredding paperwork or hiding trades in the Cayman Islands. No, their scam was subtler: convincing the world that leverage (a.k.a. borrowing ungodly amounts of money to bet on tiny price differences) was risk-free because the model said so. At their peak, they had $4 billion in equity controlling $100 billion in assets, with derivatives exposure into the trillions. It’s like putting $20 down on a roulette table and expecting to own the casino by dinner.

And here’s the kicker: it worked… for a while. From 1994 to 1997, LTCM put up Vegas-high-roller returns — 40% a year. They strutted around Wall Street like high priests of finance, dispensing equations like holy scripture. Banks, pension funds, even foreign governments lined up to hand them money. Why wouldn’t they? When two Nobel Prize winners tell you gravity doesn’t apply to their dice, you let them roll.

Then 1998 happened. Russia defaulted on its government bonds, global markets freaked, and suddenly all the neat little “convergences” LTCM bet on blew apart like a cheap cigar. Their models didn’t predict it, because of course they didn’t. Models don’t predict chaos. They predict comfort. Within weeks, the “smartest guys in the room” had set their house of cards on fire.

The danger wasn’t just that LTCM would collapse. The danger was that they were so intertwined with every major bank on Wall Street that if they went down, the rest might follow like dominos in a hurricane. Enter the New York Fed, herding a pack of terrified bankers into a smoky back room, forcing them to cough up a $3.6 billion bailout just to keep the world spinning.

There was the shot. Here is the chaser: LTCM’s scam wasn’t fraud in the felonious sense. It was hubris — that fatal belief that genius is bulletproof. They bet the farm, the livestock, and the deed to the farmhouse on the idea that markets were rational, neat, and destined to behave. The market, in turn, picked them up by the ankles and shook the change out of their pockets.

Chris Davis, 1B, Baltimore Orioles

The Loot: 7 yrs, $161M, 2016

The Return: .196 batting average over deal, no playoff appearances, retired mid-contract.

Even by today’s standards, a $23 million a year deal for a first baseman with limited defensive chops is eyebrow raising. Leading up to the 2025 season, one of the game’s top sluggers Pete Alonso couldn’t get a long-term deal so he “settled” for a two year, $54 million pact. So what were the Orioles thinking nine years ago?

Again, if we’re being fair, Davis had just come off a four year stretch where he averaged 40 home runs a season, and was an immensely popular figure in Maryland. You could make the argument that Davis was a guy the notoriously thrifty Angelos family truly needed to keep in the fold. Ok, then offer him half the duration with a higher Average Annual Value and everyone wins. One-trick pony sluggers notoriously don’t age well and Davis offered little other than prodigious power - unlike the aforementioned Albert Pujols, who in addition to being one of baseball’s all time greatest home run hitters was also an insanely intelligent and disciplined hitter, and savvy defender.

Perhaps the most jarring part of what makes this contract as cataclysmic as it was is how suddenly Davis’ performance dropped off. In the first year of his deal, Davis did hit an impressive 38 homers but also struck out a jaw-dropping 219 times. The writing was on the wall. Davis would combine to hit only 54 more homers over the next four seasons, and endure interminable periods of futility at the plate, including a 54 at bat hitless streak.

Not for nothing, Davis strikes a sympathetic figure. He and his wife are involved heavily in childrens charities, and he’s been open and transparent about his mental health struggles at a time before it was considered strong to do so. Look, kids! That guy makes zillions and he’s still as messed up as your dad is! We certainly wish it would have worked out better for Davis during his contract, but so do the damn Orioles!

The Fraud Comp: OneCoin Crypto

There’s a special place in scam history for OneCoin. Not because it was the biggest — though it stole billions from trusting wallets worldwide. Not because it was the slickest — Bernie Madoff’s bespoke Ponzi still wears that crown. No, OneCoin deserves its black velvet painting on the wall of infamy because it turned the absence of a product into a global religion.

There was no blockchain. None. Nada. Zip. Just a glorified Excel sheet running on fumes and fairy dust. And yet people lined up like they were buying Super Bowl tickets. Why? Because Ruja Ignatova, the self-styled Cryptoqueen, wore sequined dresses, wielded a German accent like a sword, and convinced ordinary folks that if they recruited enough neighbors, salvation came in the form of digital Monopoly money. It was crypto as Tupperware party — except instead of your aunt walking away with plastic bowls, you walked away broke.

And then, the ultimate con-artist flex: she vanished. As quickly as Davis’ power. Hopped a flight from Sofia to Athens in 2017 and poof — gone. No perp walk, no contrition tour, not even a farewell mixtape. Just disappeared, like a soccer manager who gets sacked midseason and quietly relocates to coach in Cyprus. Somewhere, someone knows where she is. But the rest of us are left with the financial equivalent of an empty stadium, wondering how we got taken so hard.

It worked because everyone — and I mean everyone — wants to believe in the next big thing. Bitcoin had already minted nerds into millionaires. Ethereum was exploding. The tide of FOMO was swallowing up people who thought “decentralization” was just a yoga pose. Along comes OneCoin, promising to be “the Bitcoin killer,” and boom — wallets fly open.

This wasn’t just greed. This was hope dressed up in PowerPoint slides. And Ignatova knew it. Like a cult leader with a whitepaper, she sold certainty in an uncertain world. For a while, it worked. Until it didn’t. Today, OneCoin is a punchline at finance conferences, a cautionary tale in documentaries, and a permanent scar on the faces of the millions who bought in. Greenwood, the co-founder, is rotting in prison. Konstantin Ignatov, Ruja’s brother, turned snitch and folded faster than a paper napkin. And Ruja? Still on the FBI’s Most Wanted list, probably sipping martinis somewhere under a new face and a fake passport.

Gilbert Arenas, Guard, Washington Wizards

The Loot: 6 yrs, $111M, 2008

The Return: Averaged 22 games a year post-signing, while vulturing valuable cap space.

The idea of Gilbert Arenas was always more glamorous than the reality. The era of analytics hadn’t fully taken hold yet in the NBA so not nearly enough scrutiny was given to Arenas’ overall package as a player. The 20 points per game and reckless athleticism were shiny and pretty, but all they really did was mask poor efficiency with limited defensive contribution. But on the bright side, at least Arenas was a positive locker room presence that uplifted the collective morale of his teammates. Just ask Javaris Crittendon, whom he implied he would murder over some unpaid poker winnings. Relax, bro, did you not read how money you’re making? It’s like four lines back.

Teams will tolerate just about any behavior from superstars. Yeah, everyone might hate the guy but at least he’s performing on the court. The only problem is, Arenas didn’t perform. The truly wild thing here is, Arenas only played 13 games the season prior to his massive contract, due to a serious knee injury. And the Wizards paid him nearly as much as the Lakers were paying Kobe Bryant. There’s a joke to be made here but this whole situation is so ludicrous that I’m several Glen Dronachs away from being able to put it together.

The Fraud Comp: Enron

You knew we’d eventually end up here, right? Enron wasn’t just a company. It was a swaggering peacock in pinstripes. A Texas titan that reinvented itself from a dusty pipeline operator into a Wall Street darling, promising to be the future of energy, the future of trading, hell, the future of capitalism itself. Its executives strutted on magazine covers. Fortune named it “America’s Most Innovative Company” six years in a row. Enron Field in Houston had a retractable roof and a name straight out of a cyberpunk novel.

Behind the curtain? Rot. Pure, uncut rot. Enron was less a company than a magic trick performed with accounting smoke bombs. They turned balance sheets into abstract art, hiding billions in debt inside shell companies, “special purpose entities,” and other financial Russian nesting dolls. The whole thing looked brilliant on paper. Until you realized it wasn’t paper — it was toilet paper.

Enron wasn’t making real profits. They were predicting profits and booking them today, like some junkie pawning off tomorrow’s paycheck for another hit. If they built a power plant in India that wouldn’t produce a watt of electricity for years, they counted all the future profits right now. Then, when those profits inevitably didn’t show up, they stuffed the losses in one of Fastow’s “special” entities and kept the charade rolling.

They weren’t running a company. They were running a Ponzi scheme in khakis.

In 2001, the smoke finally cleared. Journalists started poking holes in the narrative. Short sellers smelled blood. The balance sheet, once “innovative,” looked like a landfill fire. Enron stock went from $90 a share to less than $1 in months. Employees lost pensions. Investors lost billions. And the public got a front-row seat to the implosion of corporate trust.

Arthur Andersen, one of the biggest accounting firms in the world, collapsed too — guilty of shredding documents and enabling Enron’s fraud. The fallout torched not just Enron, but faith in the entire system. Out of the ashes came Sarbanes-Oxley, a law as boring as it is necessary, forcing companies to show receipts instead of vibes.

Enron wasn’t just an energy company. It was a mirror held up to corporate America, reflecting every ounce of greed, arrogance, and reckless innovation that Wall Street worships. It didn’t just fail. It failed spectacularly — leaving us with a cautionary tale dressed in cowboy boots.

To Insure Proper Service

Looking at these deals, and many more that didn’t quite ascend to this level of egregiousness, it’s like leaving your server a massive tip upon arrival at your table, only for them to take a dump in your bouillabaisse. The problem with this analogy, of course, is that sports contracts are, have always been, and always will be based on predicted future performance instead of a reward for past contributions. But still, as I sit here trying to math exactly how much I need to tip the IRS on this year’s tax bill, I can’t help but believe that with all that’s at our disposal technologically, there’s not a more reliable way to predict future value. I guess if there was, this super cool Shiba Inu I’ve been sitting on since God knows when would be worth more…

Torsten / 120 Proof Ball

Proof that the internet was a mistake.